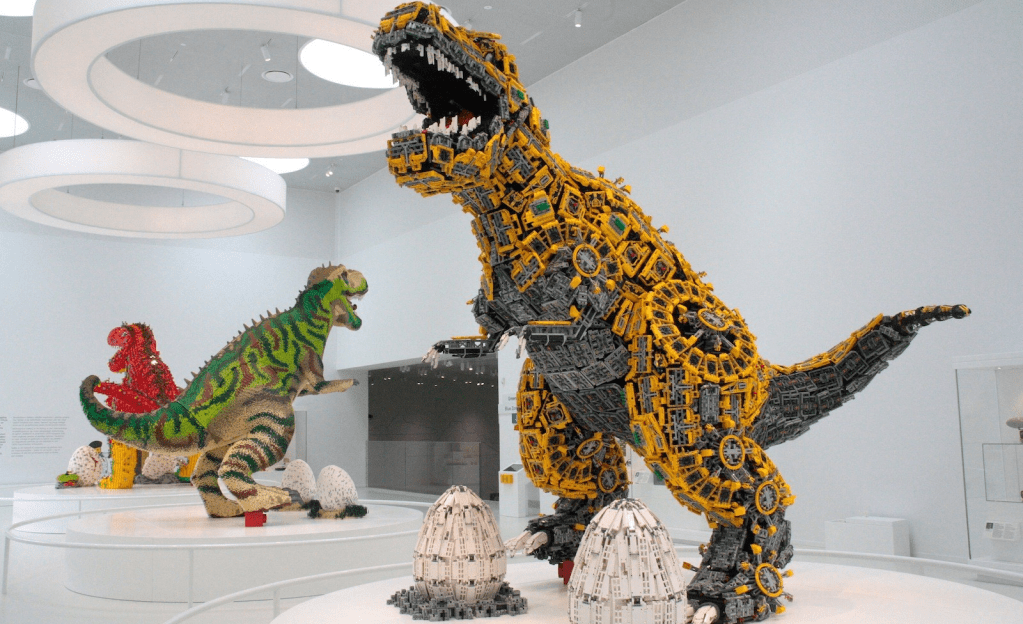

During my recent visit to Lego House in Billund, I was reminded just how much more this iconic brand represents than simply being a maker of plastic bricks. Lego is a great example of smart design, purposeful transformation, and digital innovation. Organizations aiming to stay relevant in a changing market can learn a lot from Lego’s ability to reinvent itself.

In this article, I explore three interconnected dimensions of Lego’s success: how its design principles mirror modern architectural thinking, how the company has transformed while staying true to its purpose, and how it is leveraging digital and AI to lead in both product and operational innovation.

1. Architecture & Design Thinking: From Bricks to Platforms

As a child, I already experienced the smart design of Lego—how one collection of components allowed me to create countless structures. Each brick is designed with a standard interface that guarantees compatibility—regardless of shape, size, or decade of manufacture. This is the physical-world equivalent of APIs in digital architecture: enabling endless creativity through constraint-based design.

Beyond modularity, Lego also embodies platform thinking. With Lego Ideas, they invite users into the design process, allowing them to co-create and even commercialize their models. This open innovation model has helped extend Lego’s reach beyond its internal capabilities.

Lego also uses digital twins to simulate the behavior of physical Lego components and production systems. This enables the company to test product performance, optimize assembly processes, and reduce waste—before anything is physically produced.

Lesson: Embrace modularity—not only in your product and system design but in your organizational setup. Invest in simulation and digital twin technology to test, iterate, and scale with greater speed and lower risk. And treat your users not just as consumers but as contributors to your platform.

2. Organizational Transformation: Reinvention with Purpose

Lego’s transformation journey is a great example of how established companies under pressure can reinvent themselves without losing their DNA. In the early 2000s, Lego faced a financial crisis caused by over-diversification and lack of focus. The turnaround required painful choices: divesting non-core businesses, simplifying product lines, and reconnecting with the company’s core mission—”inspiring and developing the builders of tomorrow.”

But Lego didn’t stop at operational restructuring. It also launched a broader innovation strategy to stay commercially relevant to changing customers. This included launching new experiences like The Lego Movie, which reinvented the brand for a new generation, and partnering with global content leaders such as Disney, Star Wars, and Formula 1 to create product ranges that merged Lego’s design with beloved franchises. These moves helped strengthen the brand and attract new audiences without alienating loyal fans.

Sustainability has become another important dimension—especially for a company built on plastic. Lego has committed to making all core products from sustainable materials by 2032 and is investing heavily in bio-based and recyclable plastics.

Lesson: Transformation isn’t about discarding the old; it’s about strengthening your core value and building on that foundation. Focused innovation, clear communication, and a culture that supports learning, sustainability, and adaptation are crucial.

3. Digital & AI Integration: Enhancing Experience and Performance

As a customer, I’ve already experienced how Lego.com tracks and rewards my purchases. For the younger user group, they’ve developed the Lego Life platform. Here, AI is used to moderate content and create engaging digital experiences for children. Personalization engines recommend content and products based on individual preferences and behaviors.

Lego has embraced digital not just to modernize, but to structurally improve its value chain. Robotics and automation are widely implemented in both production and warehousing. Their supply chain uses real-time data, predictive analytics, and machine learning to forecast demand, optimize production, and manage global inventory.

Perhaps the most innovative example is LegoGPT, an AI model developed with Carnegie Mellon University. It allows users to describe ideas in natural language and receive buildable Lego models in return. By converting abstract intent into tangible design, LegoGPT showcases the power of generative AI to bridge imagination and engineering.

Lesson: Use digital and AI to create meaningful impact—whether by enhancing customer experiences, increasing operational agility, or unlocking new creative possibilities.

Conclusion: Building with Intent

Lego teaches us that true transformation lies at the intersection of smart innovation, strong organizational purpose, and enabling technologies. Its enduring success comes from continually reinterpreting its core principles to meet the needs of a changing world.

For transformation leaders, Lego is more than a nostalgic brand—it’s a masterclass in building the future, one brick at a time.